Cash Flow

Cash flow, the most obvious, is the income that is generated from the rental income after your expense have been paid. This is money going into your pocket every month, like an extra pay check, and can increase over time as rent goes up with the market. Historically rental rates have gone up in Hawaii, so potential exists for your monthly cash flow to increase over time as rental rates rise.

Looking for the historic price trends for specific Hawaii neighborhoods? Contact a Locations agent who can provide it for you.

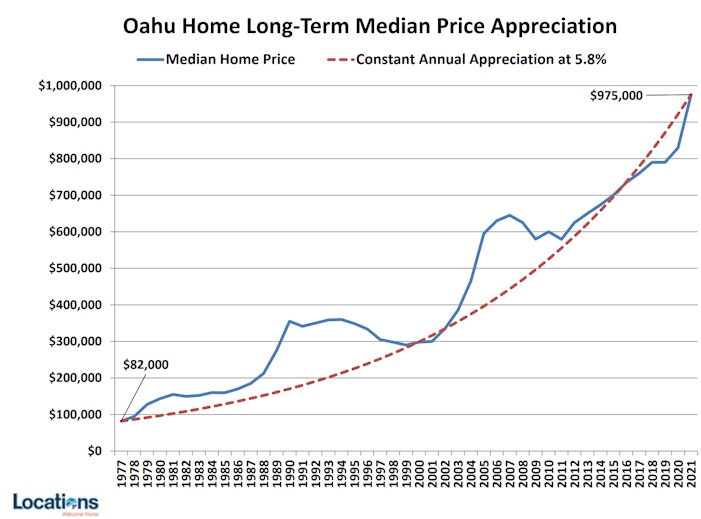

Capital Gains

Capital gains or appreciation is the increase in the value of the property after time. We have seen prices double in Hawaii a couple of times in the past and all you had to do was to own the property to take advantage of this increase. It’s an added benefit of owning a real estate investment.

Leverage

Using leverage to invest in real estate is a benefit that cannot be attained with other investments. For example, when purchasing stocks it would cost you $200,000 to buy $200,000 worth of a particular stock. When purchasing real estate, you could purchase a $200,000 investment property but only need to pay cash for 20% ($40,000) of the total property price. If prices go up 5% in this scenario, the increase in value to both the stocks and the property is $10,000, but with the real estate purchase it only cost you an upfront investment of $40,000 to have the property value increase by $10,000, whereas with the stocks it cost you $200,000 to make the same $10,000.

Even if real estate is a high-cost investment, less out-of-pocket is usually required to purchase an investment. This all depends on your borrowing qualifications with a financial institution. The amount of cash that each individual buyer needs to have on hand to purchase a property all depends on their personal borrowing qualifications with a financial institution, and the best thing to do is to talk to a loan officer to find out your buying power and to lay out your options.

Inflation Resistance

Since your monthly mortgage payment is fixed, there is inflation resistance with real estate. Goods and services go up in price, but your monthly mortgage payment does not. You may actually increase your income when you raise the rent over time for your renters.

Tax Incentives

The not-so-obvious benefits are the tax incentives: depreciation, business expense deductions, investing tax-free with self-directed IRAs and my favorite, the IRC (Internal Revenue Code) 1031 Exchange. In an IRC 1031 Exchange, an investor is able to sell their investment and buy other, like-kind investments, tax deferred.

Take, for example, a property owner who owns free-and-clear a property that was in the family since the 1940’s and had been rented out for years. If this property owner sold the house and tried to take the cash, she would have been liable for huge capital gains, since the property was originally bought for $40,000 and would sell for over $1,000,000 in today’s market. She would’ve had to pay taxes on the $960,000 capital gains, minus any improvements and monies that went into the property throughout the years which would have hurt any pocket, big time.

Instead, this property owner was able to take all the cash and invest it in a few other properties, tax deferred, to not only raise her monthly cash flow but to diversify her real estate portfolio and take full advantage of long-term appreciation.

Retirement Income

If it's time to retire, rental properties can provide a healthy, steady source of income. Your tenants can pay your mortgage and then some, providing an extra $200-$1,000 a month in rental income after mortgage and expenses.