Hawaii's most accurate home valuation tool.

Start Tracking your home's value today!

Start Tracking your home's value today!

Are you interested in a real estate career in Hawaii?

In this report you’ll find detailed, nuanced analyses of the Oahu residential real estate market that only Locations – backed by more than four decades of data and market intelligence – can provide, including:

As Hawaii’s oldest and leading locally-owned independent real estate firm, our trusted Neighborhood Experts have served Hawaii’s families since 1969. For nearly 50 years, Locations has helped more people buy or sell their homes than any other real estate firm in the state. We know you have many choices when it comes to buying or selling your home, and we thank you for placing your trust in Locations.

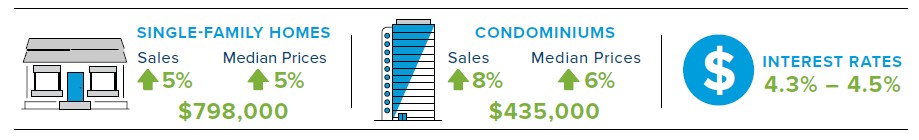

Sales of single-family homes (SFH) and condos increased by seven percent in 2017 – outpacing market expectations. Median prices also rose last year, with an increase of three percent for SFH and five percent for condos. This moderate price growth—which has existed for years now—further underscores the stability of the current market.

Strong demand will continue in 2018, while the supply of available homes is expected to remain insufficient in all but the highest prices ranges. Sales and prices are expected to climb steadily and gradually, as low inventory will constrain both sales and sharp price increases.

New single-family home construction in West Oahu, coupled with new condo developments in Kaka’ako, will help to buoy sales. However, new inventory that becomes available in 2018 will be quickly absorbed by the market, and Months of Remaining Inventory (MRI) will remain low.

With inventory at historic lows, combined with pent-up demand, Oahu’s single family home (SFH) market continues its steady climb of the last several years. SFH inventory below $1.1 million is especially constrained, pushing prices up. For the fifth consecutive year, median prices reached an all-time high in 2017, peaking to a record price of $794,000 in June.

With inventory at historic lows, combined with pent-up demand, Oahu’s single family home (SFH) market continues its steady climb of the last several years. SFH inventory below $1.1 million is especially constrained, pushing prices up. For the fifth consecutive year, median prices reached an all-time high in 2017, peaking to a record price of $794,000 in June.

Bid-ups measure the percentage of sales bid up over the asking price. Bid-ups are the primary contributing factor for rising prices. The Oahu market is very competitive, with one in every three homes bid up over asking price in 2017. The greatest competition was in the $500,000 to $750,000 price range.

Days on Market (DOM) measures the number of days from when a property is listed to when it goes into escrow. DOM remained very low in 2017, as days from listing to offer acceptance dropped to just 18 days. DOM was particularly short for SFHs priced below $1 million. Homes priced above $1 million remained on market a bit longer, as these homes attract a smaller pool of qualified buyers; however, more million-dollar-plus homes sold in 2017 than the previous year.

Absorption is measured in terms of Months of Remaining Inventory (MRI), or how quickly all available inventory would sell out based on the current rate of sales on Oahu. Six months of MRI is considered a balanced market. At 2.2 months, MRI was the lowest in more than a decade for SFHs in 2017, indicating a seller’s market.

The current real estate market is behaving differently than any previous cycle.

The past four Oahu real estate cycles have been marked by five to seven years of lower sales and flat prices, followed by three to five years of sharply increasing sales and a strong upswing in price, often with multiple years of double-digit appreciation, before leveling off again.

A typical market cycle is also characterized by an extremely competitive market environment with strong demand factors during the upswing period – low Days on Market, an increase of bid-ups over asking price,

declining inventory and increased sales.

The market has been quite competitive for the past six years, as evidenced by strong demand factors. At the same time, sales and prices have increased at moderate, stable rates of about five percent each

year – a departure from the double-digit appreciation of previous cycles.

The current low inventory also prevents significant increases in the number of home sales, which has riven large price increases in the past. A gradual increase in inventory is likely in 2018.

Strong competition in the Oahu condo market continued in 2017, with one in four condos selling for more than the asking price — pushing up median prices to $410,000, hitting a record high for the fifth year in a row.

Rising prices, high bid-ups and falling Days on Market are all hallmarks of a competitive market. Competition was particularly stiff for condos priced below $700,000.

The number of active condo listings rose above the previous year’s count in 2017. However, despite increased inventory, available condos for sale were quickly absorbed by the market and Months of Remaining Inventory is still very low at 2.8 months.

Moreover, half of all condo sellers received their asking price – or more – in 2017, another hallmark of a competitive market. The last time half of all condos sold at or above listing price was toward the peak of the last market cycle in 2005.

Interestingly, bid-ups in more moderate condo price ranges ($500,000 - $1 million) decreased slightly, while bid-ups for condos priced above $1 million dollars had the greatest increase.

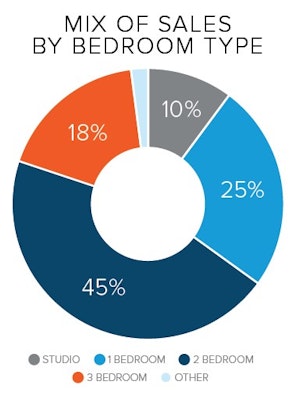

With three-bedroom condos and townhomes making up just 18 percent of all condo sales in 2017, competition was stiff for these larger units.

From listing to offer acceptance, three- bedroom condos and townhomes had the shortest median DOM of all condo types at just 17 days. These units also had the highest percentage of bid-ups, with one in three sold over asking price, compared to one in four for the overall condo market.

These competitive market conditions suggest that demand for larger condos and townhomes will likely continue to trend up in 2018.

D. R. Horton’s newest master-planned community in West Oahu, Ho’opili, is adding 11,750 homes to the Ewa Plain over the next two decades. Once complete, Ho’opili will have seven community and recreation centers, more than 200 acres of commercial farms and community gardens, and up to three million square feet of shopping and dining options. Additionally, three rail transit stations and five public schools within walking distance of many of its homes have been proposed.

Phase 1 of Ho’opili, which includes the communities of Ha’akea and Haloa, is currently under construction, with some homes already completed. Both communities offer walking and biking paths, a neighborhood park, and proximity to the first future rail transit station, the Kroc Center, Ka Makana Ali‘i shopping center and UH-West Oahu. With a mix of three- and four-bedroom single-family homes, Ha’akea offers many sought-after home features, such as parking for up to four cars, gas ranges, walk-in closets and split air conditioning. Homeowners can also opt to include an Accessory Dwelling Unit (ADU) on their property.

Haloa offers a mix of two- and three- bedroom market- priced townhomes and FLEX homes, as well as affordable townhomes and flats. FLEX homes are a unique concept that that allow for live-work space within the home, allowing residents to use a portion of their home for a commercial space, such as a salon, a traditional home office or even an extended-family suite.

Developer Castle & Cooke broke ground in late 2017 on its 3,500-home planned community, Koa Ridge, located between Mililani and Waipio. The entire project is expected to be completed within 20 years.

Developer Castle & Cooke broke ground in late 2017 on its 3,500-home planned community, Koa Ridge, located between Mililani and Waipio. The entire project is expected to be completed within 20 years.

Koa Ridge will offer a variety of housing styles, including multifamily homes. Thirty percent of the homes (1,050) will be affordable for families earning between 80 percent and 120 percent of the area median income.

Plans for the completed community include parks, gathering spaces, an elementary school and more—all connected by beautifully landscaped walking and bicycling paths.

The first phase of Koa Ridge, which will include a total of 170 market-price single-family homes, row homes and affordable multifamily units, is expected to be completed in 2019.

Four new high-profile condominium projects were added to Honolulu’s urban core in 2017— Keauhou Place, 801 South Street B, Park Lane Ala Moana and Anaha—for a total of 1,365 units.

The tremendous growth in the Kaka’ako area—which stretches from Punchbowl to Piikoi Street and King Street to Ala Moana Boulevard—began to take shape more than a decade ago with the addition of the high-end Hokua and Koolani condominium projects.

Since 2014, Kaka’ako added nine new condo projects, resulting in more than 3,250 homes – including some affordable and reserved units.

Homeowners and investors responded enthusiastically to the new construction and median prices steadily increased over the past eight years, reaching a record high in 2017.

With rents on the rise, homeownership offers a way to build long-term wealth.

Did you know that average rent prices on Oahu have doubled over the past ten years? With 43 percent of households currently renting their home – and six in 10 renters spending more than 30 percent of their income on rent – it’s no wonder that Honolulu is one of the nation’s most expensive cities for renters.

The average fair-market rent for a two-bedroom unit in Honolulu in 2017 was $2,253. Assuming no rent increases, a renter will have paid more than $135,180 in just five years toward someone else’s mortgage.

Today, there is often very little difference between a typical rent payment and a typical mortgage payment. However, investing in a home will build equity over time as the home appreciates. Paying rent, on the other hand, will not contribute to your long-term wealth.

There are also additional tax benefits to home ownership. Home ownership, especially in Hawaii, builds real wealth.

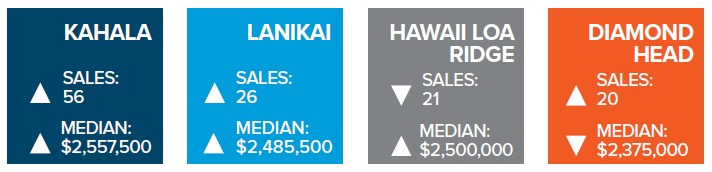

2017 was a stronger year for Oahu’s luxury real estate market than the previous year. Median prices rose in most luxury neighborhoods, while Days on Market fell in most luxury markets – especially for home prices above $5 million – compared to 2016.

Sales of single-family homes priced between $2 million and $5 million increased in 2017. In particular, homes priced between $4 million and $5 million nearly doubled, from eight in 2016 to 15 in 2017. Sales of homes priced above $5 million, however, were slightly lower.

Oahu luxury home trends include a return to traditional Hawaiian-style homes, with an emphasis on indoor-outdoor living, lush landscaping and ease of lifestyle.

In 2017, resales of condos priced at $1 million or more rose by 20 percent, while Months of Remaining Inventory fell by four months to just over 12 months. Despite unprecedented additions to Oahu’s luxury condo inventory over the past few years, demand is still evident and the pace of resales continues to increase.

Many luxury condo buyers are local residents, drawn from traditional high-end, single-family home enclaves to the convenience, amenities and prestige that new luxury condos afford. The extent of this migration of luxury homeowners from single-family residences to condos remains to be seen, but it’s safe to say that many luxury homeowners will be moving up – literally – in 2018.

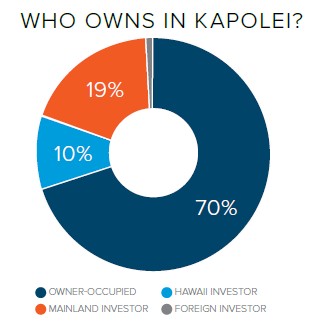

Comprised of eight neighborhoods - Kapolei Knolls, Malanai, Kumu Iki, Aeloa, Kekuilani, Iwalani, Mehana and Kapolei Kai - Kapolei offers homeowners affordability, convenience and a variety of housing types.

Median home prices in Kapolei have yet to top $1 million, but when they do, odds are that the Kapolei Knolls neighborhood will lead the way. Of Kapolei’s eight neighborhoods, only Kapolei Knolls - built in 1998 - saw median prices above $750,000 in 2017, putting homes there on par with Oahu’s overall median price. Homes in Kumu Iki (built in 1990) and Kekuilani (built in 1994) range between

$600,000 - $650,000, while homes in Kapolei’s remaining five neighborhoods - Malanai (built in 1992), Aeloa (built in 1994), Iwalani (built in 1994), Kapolei Kai (built in 2002) and Mehana (built in 2011) – range from $650,000 to $750,000.

It’s clear that our current market cycle is behaving differently than previous Oahu housing cycles. In previous cycles, we’ve seen five to seven years of lower sales and flat median prices, followed by three to five years of sharply increasing sales and a strong upswing in prices. However, we’re now entering Year Nine of our current cycle, and sales and prices have continued their steady march at stable rates of five to six percent each year—which is good news for current and future homeowners alike.

Our research suggests that an increase of about five percent for single-family home median prices is likely in 2018, which would bring the median to just under $800,000 by the end of the year. Our research also suggests that condo median prices will rise by six percent to $435,000 by the end of 2018.

Low inventory, particularly in the affordable to moderate price ranges, will continue to constrain the number of sales as well as sharp increases in median prices.

Future homeowners should partner with a knowledgeable REALTOR® to gain an advantage in this competitive market environment.

Congratulations, you have access to Hawaii's most comprehensive Real Estate Search! Please help us to better serve you by answering these optional questions.

This email is already registered. Click the button below and we'll send you a link to reset your password.

You have already registered using your FB account.

Check your inbox for an email from brokersmls@locationshawaii.com. It contains a link to reset your password.

The agent who gave you access to this website is no longer with Locations LLC.

Due to local MLS regulations, you will need to re-register if you would like to continue your access.

We will pre-fill the registration form with information in our files. Once you click Register you can either select a new agent or one will be assigned for you.

Sorry for the inconvenience, Locations LLC.

Request an appointment to view this property by completing the information below. Please note your appointment is not confirmed until an agent calls you.

Disclaimer: The properties we may show you may be Locations LLC listings or listings of other brokerage firms. Professional protocol requires agent to set up an appointment with the listings agent to show a property. Locations, LLC may only show properties marked "Active" and "ACS".

Keep your eye on this property! Save this listing and receive e-mail updates if the status of the property changes.

Share this property by completing the the form below. Your friend will receive an e-mail from you with a link to view the details of this property.

Send a message and we'll respond shortly.

We will not rent, share, or sell your information. Privacy Policy.