The Honolulu City Council is considering a new rule called the Empty Homes Tax. This tax would charge owners who leave their homes empty for a long time. The goal of the proposed bill is to encourage owners to use these homes or rent them out. Supporters also hope that the tax will help to address Honolulu's shortage of affordable housing.

How Many Vacant Homes are on Oahu?

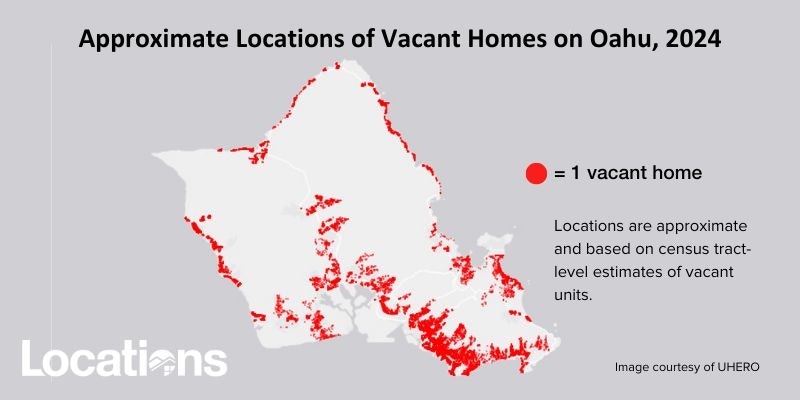

Accordinig to The Economic Research Organization at the University of Hawaii at Manoa, or UHERO, there are 26,000 vacant homes on Oahu that would be subject to the tax. UHERO estimates that the average vacant home Oahu has a taxable value of $925,000, slightly higher than the average for all residential properties.

What Is the Empty Homes Tax?

The Empty Homes Tax, known as Bill 46, aims to reduce the number of vacant homes on Oahu. By taxing empty properties, the city hopes to increase housing availability for residents. The bill was introduced August 1, 2024, by Tommy Waters, the chair of the Honolulu City Council, and Radiant Cordero, the council’s Budget Committee chair.

What is the Current Status of Bill 46?

On December 11, 2024, the City Council decided to delay voting on Bill 46. Many people shared strong opinions both for and against the tax during a public meeting. The council decided to commission a study on the issue, which is expected in early 2025, before making a decision.

Why the Delay in Passing Bill 46?

Some Council members, including Esther Kia‘aina, Val Okimoto, Augie Tulba and Andria Tupola, expressed concerns about the current version of the bill. They prefer to review the upcoming study to understand the potential effects of the tax better.

What's Next for the Empty Homes Tax?

The City Council will revisit the Empty Homes Tax after the study is completed. This study will provide more information to help them decide the best course of action. If you have questions or concerns about Bill 46, reach out to your councilmember or Locations agent.